Corporate Governance

- Basic Concept

- Corporate governance system

- Status of major shareholders

- Capital composition

- Principles regarding the determination of the amount of remuneration for officers

- Corporate Governance Report

Basic Concept

Based on our management philosophy, our basic policy regarding sustainability is to “be a company that contributes to

the world” by promoting various activities in each ESG area (environment, social, and governance).

Guided by this basic policy, with the awareness that the enforcement of corporate governance (G) is one of the important issues of management, we continuously pursue activities for our Group in order to respond to the expectations and trust of our shareholders, customers, employees, and all of society and to achieve sustainable growth.

In addition, each employee shall fully understand the H-one Group’s Code of Conduct that has been established based on the basic policy, and practice honest and ethical behavior.

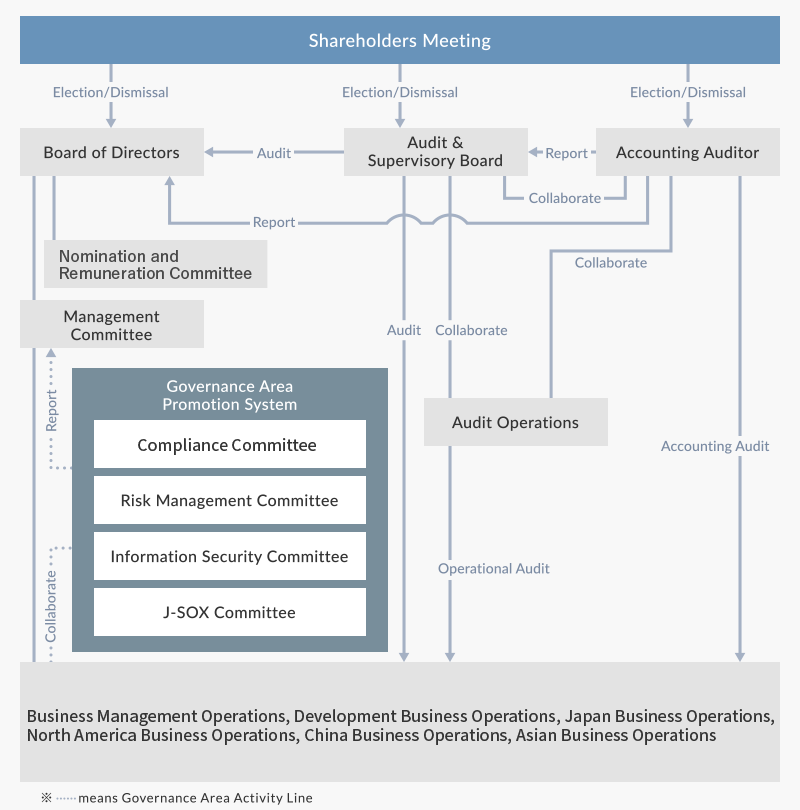

Corporate governance system

We are a company with an Audit & Supervisory Board and has established the following organs: Shareholders Meeting, Board of Directors, Audit & Supervisory Board, and Accounting Auditor. In addition, the Company has streamlined the decision-making and enhancement of supervising functions on business execution by the Board of Directors by expanding the Operating Officer system such as by delegating business execution to Operating Officers.

Board of Directors

In order to supervise business execution from a wider perspective, the Board of Directors consists of six (6) Directors, including three (3) Outside Directors. The Board of Directors, upon deliberation, passes resolutions for important matters concerning management and matters designated by laws and regulations.

The Company has appointed one (1) lawyer (male), one (1) person (male) who possesses management experience at another company, and one (1) person (female) who has experience serving at an administrative organ as Outside Directors. The Company thinks that a composition which combines Inside Directors who have a thorough understanding of the Company’s business and industry trends with Outside Directors who have varied experience, insight, and values will result in the optimal overall structure for the Board of Directors in terms of the balance of knowledge, experience, and abilities, diversity, and other aspects.

For elections of independent outside officers (Directors and Audit & Supervisory Board Members), aside from the requirements for outside officers pursuant to the Companies Act, the Company has set out a standard for designating independent outside officers so that candidates will meet qualifications of Independent Officer as stipulated by the Tokyo Stock Exchange and will be free of possible conflict of interest with general shareholders.

Audit & Supervisory Board

The Audit & Supervisory Board consists of three (3) Audit & Supervisory Board Members, including two (2) Outside Audit & Supervisory Board Members. The Audit & Supervisory Board requests, when deemed appropriate, reports on the progress and results of operational audits and internal control audits conducted by Audit Operations, which is an independent internal audit division. It also attends important meetings including the Board of Directors meetings, and audits Directors’ execution of duties and decision-making of the Board of Directors by examining the business and financial status from a neutral and objective standpoint.

Other optional meeting bodies

- The Management Committee, which mainly consists of the Representative Director and each officers of Business Management Operations, Development Business Operations, Japan Business Operations, North America Business Operations, China Business Operations, Asian Business Operations, and Audit Operations adopts a system where important matters concerning business execution are either presented to the Board of Directors after prior deliberation, or resolved within its scope of authority and reported to the Board of Directors for an efficient and speedy decision making by the Board of Directors.

- To ensure mutual collaboration between Outside Directors and Audit & Supervisory Board Members, the Information Exchange Meeting for Independent Officers, which consists of Independent Officers and Full-time Audit & Supervisory Board Member, is held monthly. At the Information Exchange Meeting for Independent Officers, understanding is shared through reports of business status of the Company Group made by Full-time Audit & Supervisory Board Member, or by related general managers or chief operating officers when needed, and opinions which are mutually exchanged among Independent Officers.

- In order to ensure transparency and objectivity in the process of determining remuneration, the Nomination and Remuneration Committee, chaired by Outside Independent Directors, determine, after final consultation, the amounts of remuneration, etc. for the Company’s Officers. Moreover, if changes are to be made on the policy concerning determination of calculation methods for the amounts of remuneration, etc. for Officers, they are determined by the Board of Directors after prior deliberation at the Nomination and Remuneration Committee.

Status of major shareholders

As of March 31, 2024

| Shareholder Name | Number of the Shares Owned (Thousands of Shares) |

Percentage of the Shares Owned (%) |

|---|---|---|

| Honda Motor Co., Ltd. | 6,055 | 21.33 |

| The Master Trust Bank of Japan, Ltd. (Trust Account) | 1,724 | 6.08 |

| H-ONE Employees’ Stockholding | 1,163 | 4.10 |

| Saitama Resona Bank, Ltd. | 780 | 2.75 |

| INTERACTIVE BROKERS LLC | 767 | 2.70 |

| JFE Shoji Corporation | 727 | 2.56 |

| Toko Miyamoto | 726 | 2.56 |

| Custody Bank of Japan, Ltd. (Trust Account) | 636 | 2.24 |

| Shoko Ujiie | 589 | 2.08 |

| Custody Bank of Japan, Ltd. (Trust Account 4) | 573 | 2.02 |

Capital composition

Foreign shareholding ratio: less than 10%

Principles regarding the determination of the amount of remuneration for officers

The Company’s Board of Directors resolves matters related to remuneration for directors and Audit & Supervisory Board Members, including the policy regarding the determination of the details of remuneration for individual directors, after prior deliberation by the Nomination and Remuneration Committee. In the event of any changes to policy regarding the determination of the calculation method for the amount of remuneration, etc., the Board of Directors will pass a resolution after prior deliberation by the Nomination and Remuneration Committee.

The remuneration structure of the Company’s Directors and Audit & Supervisory Board Members, which is based on this policy, is as follows.

| Types of remuneration | Basic remuneration (Monetary remuneration) |

Performance-based remuneration (Monetary remuneration) | Medium to long-term incentive remuneration (Share-based remuneration) |

|---|---|---|---|

| Positions eligible for payment | (1) Directors (2) Outside Directors (3) Audit & Supervisory Board Members |

(1) Directors (2) - (3) - |

(1) Directors (2) - (3) - |

| Maximum amounts, etc. | Directors: Up to 200 million yen per year Audit & Supervisory Board Members: Up to 40 million yen per year |

Every 3 fiscal years Under 300 million yen (under 350,400 shares) |

|

| Content of remuneration |

・Within the maximum amount resolved at the General Meeting of Shareholders, the Nomination and Remuneration Committee determines the specific allocation of remuneration based on the Remuneration Regulations for directors and auditors. ・In case of temporary treatment that differs from the executive compensation rules, the Nomination and Remuneration Committee will discuss the matter and the Board of Directors will make a decision. |

・Points are granted to those eligible in accordance with the Regulations on Delivery of Shares for Officers. The Company provides shares of stock in proportion to the number of points granted to retired directors who satisfy the requirements for beneficiaries as stipulated in the Regulations on Delivery of Shares for Officers. | |

- Note 1: The ratio of the above three types of compensation to the annual remuneration of internal directors is determined by position, and designed so that higher positions have the higher ratio of performance-linked remuneration.

- Note 2: Specific remuneration levels are set with reference to the results of the “Executive Remuneration (Salary) Survey of Private Companies” by the National Personnel Authority and the Executive Compensation Survey of private professional organizations.

The total amount of remuneration, etc. for the current fiscal year is as follows.

| Classification of officers | Total amount of remunerations (million yen) |

Amount of remuneration by class (million yen) | Number of eligible officers | ||

|---|---|---|---|---|---|

| Basic remuneration | Performance-based remuneration | Share-based remuneration | |||

| Directors (excluding Outside Directors) |

90 | 66 | 8 | 15 | 3 |

| Audit & Supervisory Board Members (excluding Outside Members) |

17 | 17 | ― | ― | 1 |

| Outside Directors | 12 | 12 | ― | ― | 3 |

| Outside Audit & Supervisory Board Members | 7 | 7 | ― | ― | 2 |

- Note 1: Amounts shown in the “Share-based remuneration” column is the amount of provision for allowance for directors’ stock benefits.